At riksgalden.se, we use cookies to improve your experience on our website and to collect statistics. We also use cookies for analyzing to improve our website. More about cookies.

Kingdom of Sweden lends EUR 1.5 billion to the Riksbank

Press release 5 February 2015

Kingdom of Sweden issues EUR 1.5 billion (approximately SEK 14 billion) in a new five-year bond at a yield of 0.076 per cent. The proceeds will be used to refinance maturing on-lending to the Riksbank.

The order book was quickly oversubscribed with a volume exceeding EUR 3.6 billion. Over 60 investors primarily from Europe and Asia took part in the deal. The transaction was priced at mid-swaps minus 24 basis points and has the lowest-ever coupon for a sovereign syndication in EUR.

|

Issuer |

Kingdom of Sweden |

|

Size |

EUR 1.5 billion |

|

Coupon |

0.050 % p.a. |

|

Maturity date |

12 Feb 2020 |

|

Price |

99.870 % |

|

Yield |

0.076 % p.a. |

|

Spread versus EUR mid swaps |

Minus 24 basis points |

|

Spread versus EUR benchmark |

10.8 basis points |

|

Lead managers |

Danske Bank, Deutsche Bank och Goldman Sachs International |

In 2015, the Debt Office plans to issue foreign currency bonds equivalent to SEK 97 billion. The volume includes refinancing of on-lending to the Riksbank equivalent to SEK 57 billion. The balance after today’s issue is around SEK 63 billion.

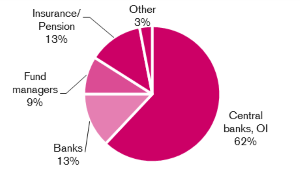

Distribution by investor and region

For more information, please contact:

Anna Sjulander, Deputy Head of Funding, +46 8 613 47 77